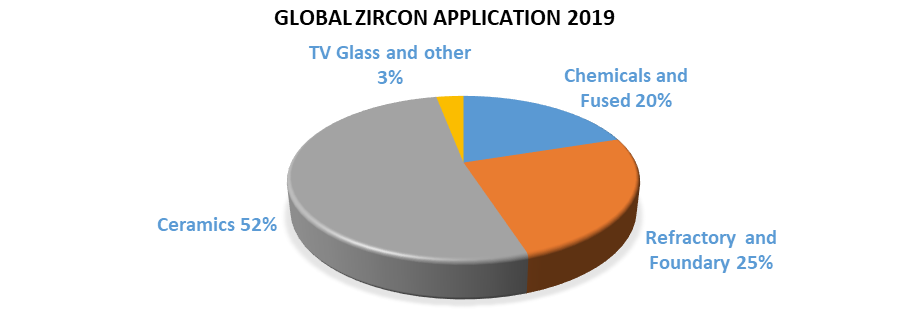

Zirconium Market UpdateZircon global demand The global demand for zircon sand in 2019 was 1.2Mtpa. The annual growth rate in demand has been around 1.5% for the last 5 years. This demand is forecast to increase to 2.7% from 2020-2023 (source : TZMI) Demand for zircon sand has been soft during the start of 2020 but this is thought to be short term and due to some global economic uncertainty and destocking of downstream supply chains. Solid long term fundamentals, such as increase in Asian and African middle classes and also continued urbanisation, are expected to drive demand going forward. Ceramics, such as tiles, sanitary ware amd table ware, are making up more that 50% of zircon sand consumption.

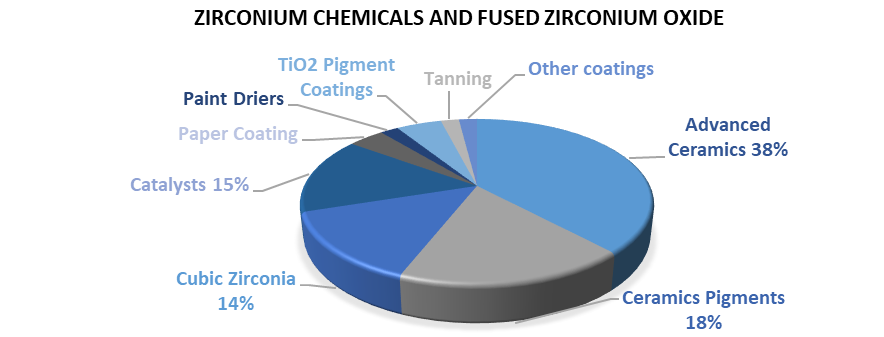

The zircon sand market value is in the region of USD 1.5B Zirconium Chemical and Fused Zirconium Oxide In 2019 the demand for zircon sand for the production of zirconium chemicals and fused zirconium oxide was in the region of 240ktpa which produced around 170ktpa of down stream products. China accounts for around 90% of global output of zirconium chemicals and zirconium oxide. The main zirconium chemicals produced are zirconium oxychloride, zirconium basic carbonate and zirconium oxide and they are used in the following applications:-

(source : Alkane) The annual forecast growth in demand for zircon sand in the production of zirconium chemicals and fused zirconium oxide is expected to be 3-6% between 2020 and 2025. The estimated market value of these downstream zirconium chemicals and zirconium oxide was USD 2.0B in 2019. Zircon global supply

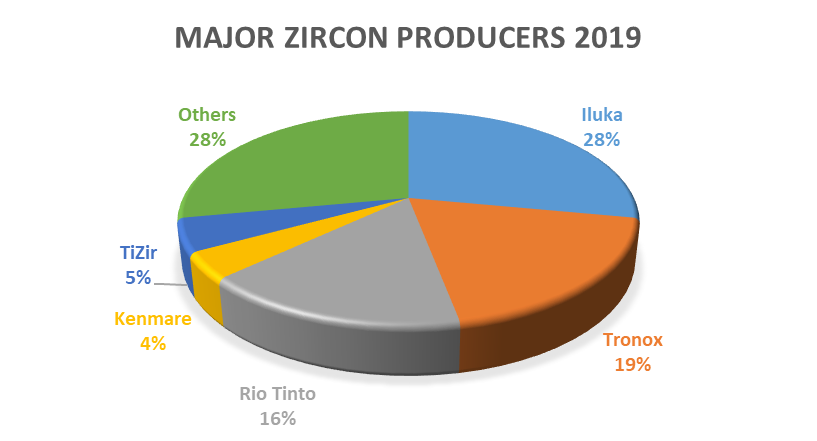

(source : Iluka) There is currently a general lack of quality mineral sand projects, particularly with high zircon assemblage, and a depletion of existing operations. The supply annual growth forecast for 2020-2025 is -3.6%. The market has broadly been in the balance during 2018/209 but the supply tipping point is expected in 2020 when we will move into a structural deficit going forward to 2025 and beyond. Even under subdued demand growth, less than the 2.7% forecast, there will be an expected deficit over the next 5 years (source : TZMI / Iluka) The issue with a supply shortage is the limited options for short term response, long lead times for new developments and the significant capital investment required to develop a new resource. The supply and demand imbalance over the coming years is likely to lead to an upward pressure on zirconium product pricing going forward.

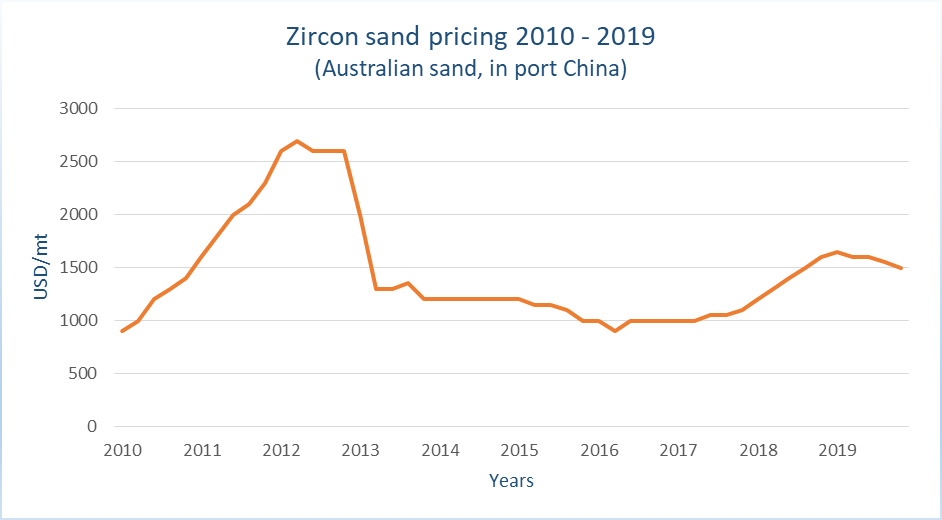

Zircon sand pricing In 2012 the price of zircon sand reached a peak of USD 2700/mt. This saw a subsequent drop off in demand in the following years as applications looked to substitute zircon with competing minerals or eliminate it totally from product formulations. Annual demand reduced from 1300ktpa in 2011 down to 1000ktpa in 2013. This drop off in demand led to the creation of large stockpiles which took a number of years to work through. Pricing during 203 to 2015 dropped back to levels of USD 1000-1200/mt. With steady growth in demand and reduced stockpiles, prices started increasing again in 2016 to 2019 to the current levels of USD 1500-1600/mt CIF China. Zircon demand in 2019 was 1200ktpa

Historic Zircon Sand pricing 2010-2019

With the forecast supply deficit for zircon starting in 2020 there is likley to be a firming up of prices during the first half of the year to around USD 1600/mt, with some increases towards the end of the year. With some increases in zircon prices during the year there will be a firming of zirconium chemical prices, including zirconium oxychloride, zirconium basic carbonate and zirconium oxide. Availability of raw material however for these products is not expected to be an issue. With any limit in availability the supply tends to be channelled to the higher value products, which includes the upstream chemicals.

Date : 01-03-2020 |